Weekly Market Commentary -4/15/2022

-Darren Leavitt, CFA

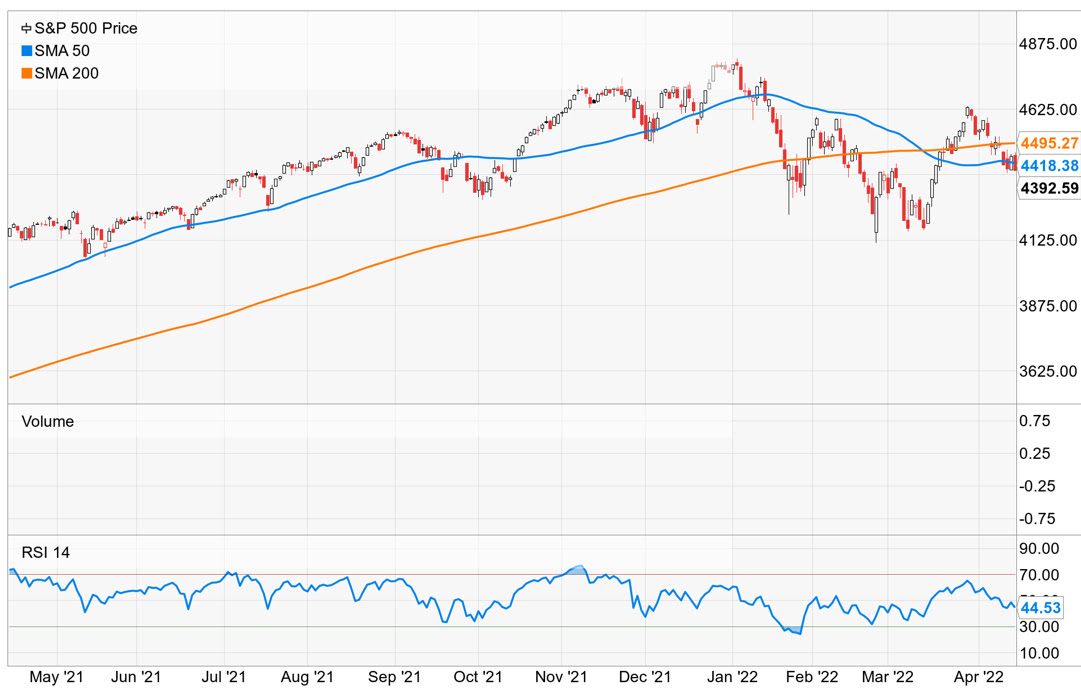

First-quarter earnings season kicked off with mixed results from the financials and positive results from the airlines. The holiday-shortened week found US equities taking one step forward only to subsequently move two steps back. Robust inflation data steepened the yield curve and hit growth issues particularly hard. Technically the S&P 500 could not regain its 200-day moving average (4495), and perhaps more troubling was the regression below its 50-day moving average (4418).

The S&P 500 lost 2.39%, the Dow gave up 0.39%, the NASDAQ fell by 3.93%, and the Russell2000 was able to inch higher by 0.52%. Whipsaw action in the US Treasury market ended with a significant steepening of the curve. A couple of weeks ago, the 2-10 spread inverted, but now the 2-10 spread has gone to thirty-eight basis points. It is also worth mentioning that there is no inversion across the curve. The 2-year note yield decreased by seven basis points to close at 2.45%. The 10-year yield hit a high for the year, increasing seventeen basis points to 2.83%. The increase in yields also pushed the average 30-year mortgage to 5%, a level not seen in eleven years. Gold prices increased by 1.5% or ~$30 to $1974.50 an Oz. Oil prices rebounded by 7.8% on the week, with WTI closing at $105.92 a barrel. Copper prices were unchanged on the week.

Inflation data released for the week included March CPI and PPI. Headline March CPI came in at 1.2%, slightly less than the street estimate of 1.3%. However, the reading was up 8.5% on a year-over-year basis, the largest increase since 1981. Core CPI, which excludes food and energy, also came in below expectations at 0.3% and showed a meaningful move on a YoY basis of 6.5%. Headline PPI came in hotter than expected at 1.4% and Core PPI was much higher than expected at 1%. On a year-over-year basis headline, PPI increased by 11.2%. Interestingly, the market rallied on the news as a peak inflation narrative made its rounds. Perhaps we do get some inflation relief but it appears inflation will likely be elevated for longer than most had anticipated. Other economic data indicated the economy was still on solid footing. Markets sold off on the news, and growth stocks again to the brunt of the sell-off. March Retail sales came in at 0.5% versus expectations of 0.6%. The Ex-auto reading came in at 1.1% versus the estimate of 0.9%. The labor market continued to be tight. Initial Claims were up 18k to 185k, and Continuing Claims fell by 48k to 1.475 million. Preliminary April University of Michigan Consumer Sentiment came in at 65.7, above the consensus estimate of 58.8 and the prior reading of 59.4.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.