Weekly Market Commentary – 11/26/2021

-Darren Leavitt, CFA

The holiday-shortened week turned into a wild ride for investors as a new variant of Covid upended the reflation trade, which sent volatility through the roof. The new variant called Omicron was first discovered in South Africa. Scientists are still assessing the variant, but reports that it may be more contagious than the Delta variant and concerns that our current vaccine arsenal may be ineffective prompted the notion of more national lockdown measures. Recall Austria recently instituted a nationwide lockdown, and it now appears more likely that other European nations may take similar measures. Early in the week, the S&P 500 was able to forge another record high. President Biden’s nomination of Jerome Powell as Federal Reserve Chairman and Lael Brainard as Vice-Chair seemed to soothe markets. An announcement from the US and four other countries to tap their Strategic Petroleum Reserves was also taken in stride; oil traded up on the news- perhaps on expectations that OPEC + might curtail their production next year.

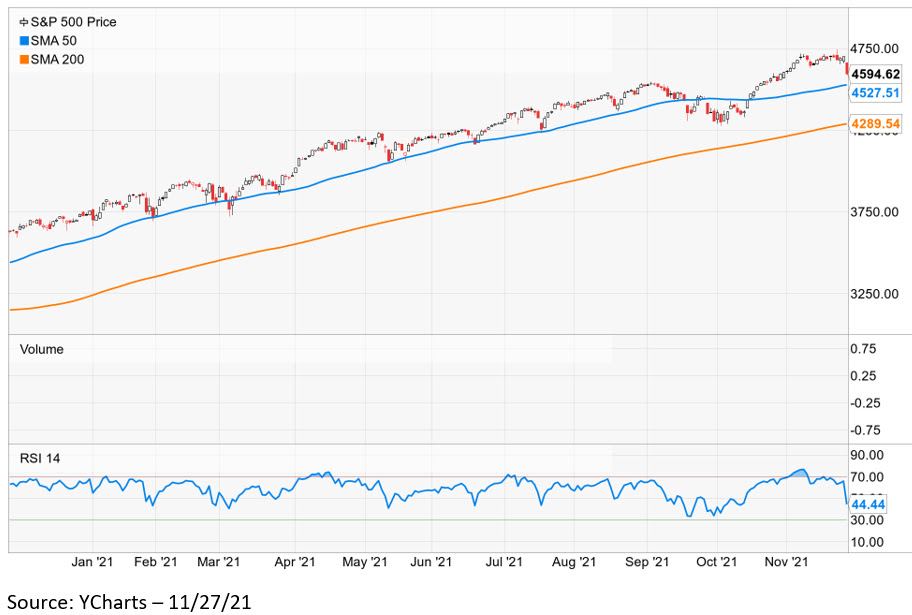

The S&P 500 lost 2.2% for the week, the Dow gave back 2%, the NASDAQ fell 3.5%, and the Russell 2000 sank 4.1%. US Treasuries trade was extremely volatile. On Friday, the 2-year note yield fell fourteen basis points and ended the week one basis point lower at 0.51%. Similarly, the 10-year note, which touched 1.70% early in the week, closed down six basis points at 1.49%. Notably, the probability for a Fed Funds rate hike in June of 2022 decreased from over 80% to just under 40%. Oil prices tumbled on Friday, losing 13%, and were down 10% for the week. WTI closed at $68.17 a barrel. Gold prices fell 3.2% or $59.5 to close at $1792.30 an Oz.

On Wednesday, an economic data dump was highlighted by a Continuing Claims number that came in at 199k, well below the estimate of 260k. Continuing claims came in at 2.049 million. For October, Personal Income and Spending were better than expected, coming in at 0.5% and 1.3%, repetitively. The final University of Michigan Consumer Sentiment for November came in at 67.4 versus the consensus estimate of 66.8. Finally, PCE Prices came in line with expectations on both the headline and Core measure. However, the overall measure showed a 5% year-over-year increase higher than September’s year-over-year increase of 4.4%.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.